This fund is available for both Bumiputera and Non-Bumiputera Malaysian depending on the availability of units of the Fund.

Now, let's take a look at some important information of ASN3 abstracted from the Annual Financial Report as of 31 Nov 2011*

(As of posting date, the ASN3's Annual Financial Report for 31 Nov 2012 has yet to be released)

Asset Allocation as of 31 Nov 2011

Equity Market - 55.51%

Fixed Income Security - 6.85%

Other Instrument Market Models and Assets - 37.64%

Average Annual Returns as of 31 Nov 2011

The average annual returns for the ASN3 over a period of 1, 3 and 5 years are shown in the table below:

For Malaysians who do not understand Bahasa Melayu, the translation as follows:

"Jumlah Purata Pulangan (%)" is defined as "Total Average Returns".

"Penanda Aras (%)" is defined as "Benchmark Value"

Fund Annual Performance On Year to Year Basis

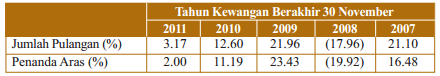

The fund's actual performance on a year to year basis from 2007 - 2011 are shown in the table below:

"Jumlah Pulangan (%)" is defined as "Total Returns"

"Penanda Aras (%)" is defined as "Benchmark Value"

Top 3 Kuala Lumpur Stock Exchange (KLSE) Indices Invested by ASN3 as of 30th Nov 2012

Top 3 KLSE Indices Invested by ASN3

1. Services Indice (21.20% of NAV - RM 26,254,762)

2. Financial Indice (15.84% of NAV - RM 18,651,755)

3. Plantation Indice (1.73% of NAV - RM 4,868,496)

From the top 3 indices invested by ASN3, we have listed out the top three Equities for each of the indice as shown below:

Top 3 Equities Invested in Services Indice:

1. Axiata Group Berhad

2. Sime Darby Berhad

3. Tenaga Nasional Berhad

Top 3 Equities Invested in Financial Indice:

1. Malayan Banking Berhad

2. CIMB Group Holdings Berhad

3. Public Bank Berhad

Top 3 Equities Invested in Plantation Indice:

1. IOI Corporation Berhad

2. Kuala Lumpur Kepong Berhad

3. Kulim (M) Berhad

Annual Expense Ratio for ASN3 as of 30 Nov 2011

Management Fee : 1% Per Year Over NAV

Trustee Fee : 0.08% Per Year Over NAV

Transaction Information

Summary

Returns of 3.17% for this Fund for Financial Year 2011 has certainly discourage me from buying this fund. Although it has outperformed the benchmark of 2.00%, the 3.17% return is almost similar to the placing your money in a Fixed Deposit Account. Considering the fact that the fund has more then 50% of its NAV invested into KLSE, I would have expect the returns to be much higher then 3.17%.

There's much to be questioned on the ability of the fund managers incharge of ASN3 fund if you compare year 2011 returns from ASN3 (3.17%) with the Amanah Saham Gemilang's fund returns of 15.04% (ASG-Pendidikan), 16.33% (ASG-Kesihatan) and 14.44% (ASG-Persaraan).

I'm looking forward for the Annual Financial Report for ASN3 for Financial Year End 30th Nov 2012. From that report, I believe I can make further judgement on the performance of this fund.

With that I end my 3-part ASNB fund introduction and review. It is my great hope that you find the reviews beneficial and helpful towards deciding the best fund to invest in.

Cheers and Happy Investing

MY Investor

Related Articles / Post:

No comments:

Post a Comment